- Loans and Financing

- Claims Financing

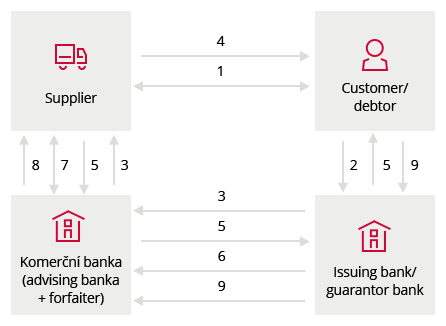

- Forfaiting

Forfaiting

Purchase of receivables to maturity arising from past transactions on a without recourse basis

Receive payment immediately after

delivery of goods and acceptance of documents

delivery of goods and acceptance of documents

Forfaiting costs can be reflected in purchase prices

Win customers by offering deferred due date

Funds available for current needs

No need to increase your debt level