Operating lease

Preservation of liquidity

Repayment from investment returns

Flexibility and upgrades

Additional benefits of operating lease

- It does not increase the proportion of external resources (liabilities) on your balance sheet

We own and depreciate the asset, and hold it on our balance sheet. The lease payments on your side are only entered in your profit and loss account. - Servicing and operational risks

By agreement, servicing and operational risks can be included in the contract. This allays ownership-related concerns.

- Option to return or exchange

At the end of the contract, you can simply return the asset, exchange it for a new one, or extend the contract. - Simple cash-flow planning

Payments under operating lease are fixed, making them straightforward to predict.

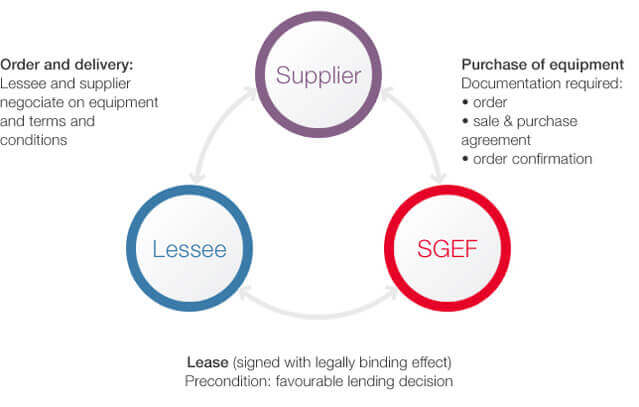

An operating lease is a rental arrangement where we provide the equipment you select for a set period. At the end of the lease term, you are not obligated to purchase the equipment. Throughout the lease, you make monthly payments that cover the rental and may also include services such as maintenance, insurance, and repairs.

At the end of the lease term, you return the equipment to the leasing company or exercise the option to purchase it. This product is ideal for businesses that want access to new technology without long-term commitments and the responsibility of managing it.

Operating lease offers flexibility and help to optimise operational asset costs, which is particularly beneficial for businesses looking for efficiency and low operating costs.