Economic sustainability

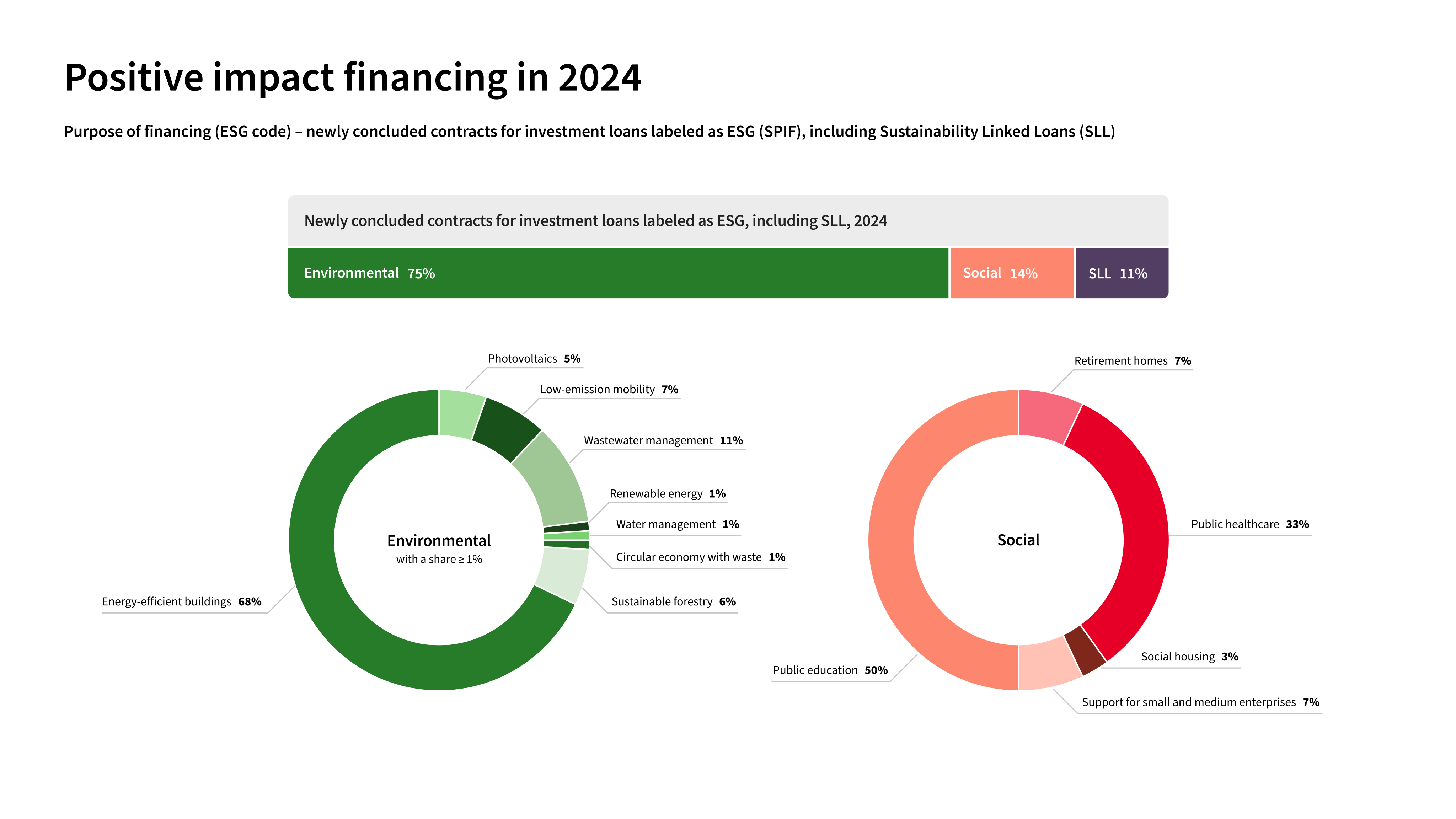

In 2024, KB entered into new contracts for investment loans identified as ESG beneficial in the amount of CZK 20.4 billion. The majority (75%) of the new loan agreements identified as ESG-beneficial were environmentally beneficial, around 14% financed social benefits, and 11% of these new loans were linked to a combination of environmental and social objectives.

Climate change and its consequences, such as drought, floods or change in the weather pattern, can heavily influence the revenue and cost sides of companies and their projects. Investment and its value can therefore be considerably impaired. This is one of the reasons why we regard the climate change as a challenge for which we have to be prepared. It is crucial that we keep seeking innovations that will help us in our fight against the adverse impacts. Mitigation and adaptation are frequently mentioned in connection with reducing the adverse impacts of climate change.

Mitigation is understood to be prevention, within the meaning of mitigating the root cause. We pursue a large number of mitigation activities in our business. We are reducing our carbon footprint, and energy and water consumption, and we care about process efficiency.

- You can find more about our mitigation activities here

We also support projects that mitigate the impacts of climate change through our financing. Examples include investments in more economical equipment, funding of installations for reducing pollutant release into the air, water, or soil, or funding of CHP retrofits.

Adaptation serves as coping with the impacts of the changing climate. It therefore means changes and adjustments that help to reduce vulnerability to climate change impacts. We fund projects geared towards expanding greenery in municipal and other areas, improve biodiversity, or support farming, thereby helping to adjust to the already ongoing changes.

As its parent company, Société Générale, Komerční banka is aware of the need to look for responsible ways of financing.

In managing our clients’ funds we therefore do not take into account their prosperity only but also respect for environmental and social principles. Thus, we are knowingly helping to minimise the negative impacts on the environment and society.

Equator Principles: In the financing of large infrastructural and industrial projects, the entire SG Group follows the Equator Principles, a voluntary risk management framework for assessing environmental and social risks in major projects based on The World Bank’s international standards.

Global Partnerships: SG Group is also a founding member of the United Nations Environment Finance Initiative (UNEP FI), a UNEP partnership for sustainable development, a programme of global partnerships between the UNEP and the financial sector.

Sustainable Development Goals: In 2019, SG Group signed the Principles for Responsible Banking, thereby committing the entire financial group to integrating Sustainable Development Goals into all its activities, including the adoption of the Paris Agreement goals.

Czech Banking Association & Sustainable Finance

In 2021, the Czech Banking Association (CBA) member banks set up a Sustainable Finance Commission. Ms Hana Kovářová, KB’s Executive Director, Brand Strategy and Communication, was elected as the Commission Chair. We have also signed the CBA Sustainable Finance Memorandum, in which we and other banks confirmed our commitment to create a business environment conducive to the country’s sustainable and socially responsible development. In October 2023, we launched a standardised banking ESG questionnaire that we use to gather ESG information from our clients. The advantage for bank clients is that they only need to complete the questionnaire once and the other banks involved in the initiative can then use the data as well. CBA members also elected their representatives to the governing bodies in 2023 and Jan Juchelka, CEO of Komerční banka, was elected as the new CBA President.

In 2019, SG Group adopted its Climate Strategy as part of contributing to the fight against the climate change. SG Group is committed to refraining from providing any new active financing to companies having the greater part of their annual revenue linked to the coal sector (coal mining and transport, coal trading, and energy use of coal for electricity or heat generation).

KB has decided to phase out the funding of clients associated with coal mining or use, in particular in the electricity and heat supply industries. We thus help to exert pressure on these companies to transit to cleaner energy sources. We are committed to progressively reducing to zero by 2030 our funding of clients’ activities in the coal sector. As of 2022, we will lend only to companies, even if associated with coal activities only partly, that have a clearly stated commitment to discontinue their coal activities until 2030.

The objectives and requirements arising from the voluntary commitments are included in our General E&S Principles which are applicable across SG Group. The general principles are complete with sectoral policies setting out SG Group’s detailed environmental and social rules and standards for funding business activities and projects in the following sensitive sectors:

We refrain from financing businesses that are unacceptable from the perspective of E&S principles (e.g., coal mining and burning, manufacture of certain types of weapons or export of arms to some risky countries, or to countries with an increased risk of illegal arms trade, companies that fail to comply with environmental regulations).

An E&S Risk Management System in corporate sector financing

At the beginning of 2020, Komerční banka put in place a system for targeted screening of environmental and social risks of corporate clients, primarily companies operating in sensitive sectors. KB’s environmental expert conducts the screening. The objective of the system is to make sure that the client’s business satisfies the requirements of environmental, labour and social regulations and that no reputational or credit risk is associated with the client/transaction.