Material topics

KB Group respects the human rights of all persons with whom it engages. KB Group’s activities influence different parties’ interests. The Group has identified the following stakeholder groups on whose interests its activities are impacting considerably, and KB Group therefore respects such interests in all its activities:

- Individual clients (consumers)

- Business and corporate clients, including municipalities

- Shareholders

- Financial markets, including rating agencies and bond investors

- Regulatory authorities

- The public, including future generations

- Employees and other staff

- Trade partners, including suppliers

KB Group seeks to understand the interests and needs of its stakeholders by directly engaging with them and by continuously building and developing the body of expert knowledge of its experts in its companies.

KB Group relies on the general topics structured in dimensions by the SASB (Sustainability Accounting Standards Board) standards developed by Value Reporting Foundation for determining the materiality of the various topics for each group of stakeholders and for its prospects for growth, costs, and risks. This list identifies the material topics that are reasonably likely to impact on the financial condition or operating performance of companies and are therefore important for investors. In the subsequent internal discussion, the Group may further extend the range of the topics.

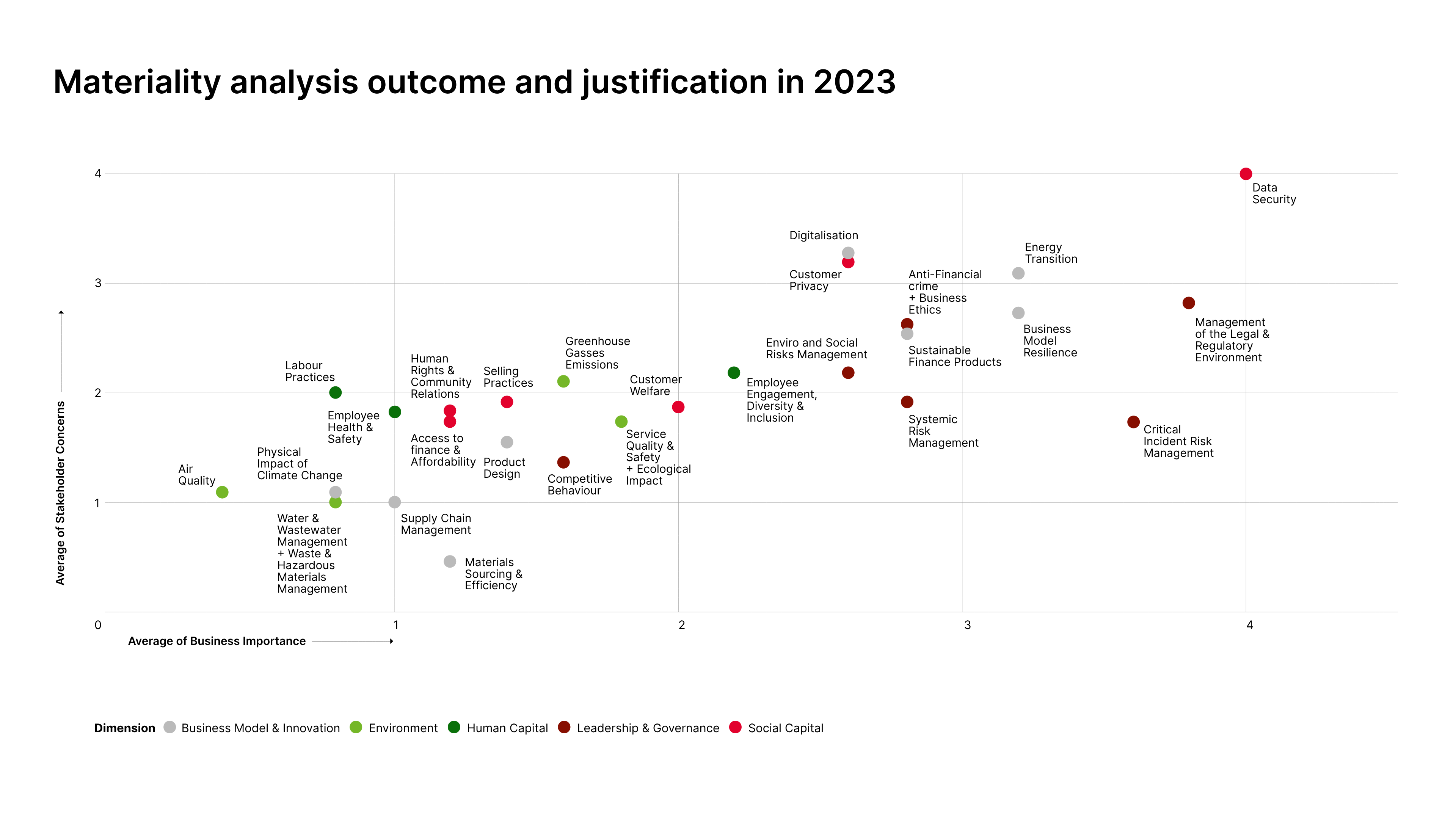

The outcome of materiality analysis is visualised in a scatter diagram with the importance of a topic for stakeholders shown along the vertical axis and that for the Group’s financial, business and risk prospects shown on the horizontal axis.

These evaluations are revised annually, along with a review of the list of stakeholders.

For the most important topics identified in the materiality analysis, KB Group describes their main impacts on the economy and on people, but also their interlinking with negative impacts. The analysis provides information about the possible directions of activities that can be pursued to manage each of the topics and its impacts, including the development of related policies and commitments. It also provides a basis for evaluating the effectiveness of the activities undertaken and for reporting.

Of the topics significant for stakeholders and prospects of Komerční banka, the following five were ranked as the most material:

1) Data security

The category addresses management of risks related to collection, retention, and use of sensitive, confidential, and/or proprietary client or user data. It includes social issues that may arise from incidents such as data breaches in which personally identifiable information (PII) and other user or customer data may be exposed. It addresses a company’s strategy, policies, and practices related to IT infrastructure, staff training, record keeping, cooperation with law enforcement, and other mechanisms used to ensure security of customer or user data. Trust and credibility are the foundations of banking. Banks are guardians of valuable data on their clients, other business partners, and their own operations. Weakened trust in the ability of a financial institution to keep its data safe can have profound implications for reputation and competitiveness of such a bank or financial group.

2) Management of the Legal & Regulatory Environment

The category addresses a company’s approach to engaging with regulators in cases where conflicting corporate and public interests may have the potential for long-term adverse direct or indirect environmental and social impacts. The category addresses a company’s level of reliance upon regulatory policy or monetary incentives (such as subsidies and taxes), actions to influence industry policy (such as through lobbying), overall reliance on a favourable regulatory environment for business competitiveness, and ability to comply with relevant regulations. It may relate to the alignment of management and investor views of regulatory engagement and compliance at large. Financial institutions must also stay ready for intense supervisory and policy dialogues on topics such as profitability, capital adequacy, automation, digitalisation, and risk management frameworks, even as banks increasingly have been mandated with complying with certain public responsibilities, including in the areas of preventing financial crime, consumer protection, and financial stability.

3) Energy Transition

The category addresses environmental impacts associated with energy consumption. For a financial services company, it comprises risks and opportunities related to the process of energy transition for its clients and the economy as a whole. This structural change of the energy system has a potential to determine long-term prosperity, resilience and sustainability of whole economies or even regional blocks, such as the European Union. It involves building capacity to evaluate and finance diverse projects and organisations influenced by the changes regarding energy supply and consumption. Furthermore, it addresses the company’s management of energy efficiency and intensity, energy mix, as well as grid reliance.

4) Business Model Resilience

The category addresses an industry’s capacity to manage risks and opportunities associated with incorporating social, environmental, and political transitions into long-term business model planning. This includes responsiveness to the transition to a low-carbon and climate-constrained economy, as well as growth and creation of new markets among unserved and underserved socio-economic populations. The category highlights industries in which evolving environmental and social realities may challenge companies to fundamentally adapt or may put their business models at risk. Within the financial services industry, the landscape in Europe is changing, partly due to disruptive digital innovation and the threat of competition from both banks and non-banks. Banks must therefore establish their paths to sustainable and viable business models to remain in the market, and the winners must ensure that their model can sustain an increased volume of business. In addition to substantial market pressure, banks must also prepare for intensifying supervisory dialogues on topics such as profitability, automation and digitalisation, risk management frameworks, and controlled transition following banks’ consolidation.

5) Digitalisation

The recent wave of innovation in the financial services industry based on digitalisation is bringing a broad range of challenges and opportunities characterised by (a) evolving client needs – with emphasis on reliability, trust, and partnership with clients; (b) need for simple and fast but personalised solutions accessible anywhere and anytime; (c) changing competitive landscape – with considerable pressure on profit margins, disruption caused by fintech and neobanks, and scale as a requisite for efficiency; and (d) technological revolution – transforming legacy banking systems, changing client expectations, new development practices and ways of working and analysing data, big leaps in productivity, strengthening the role of technology providers across industries.