Internet Banking Autumn Improvement

News in Internet Banking MojeBanka

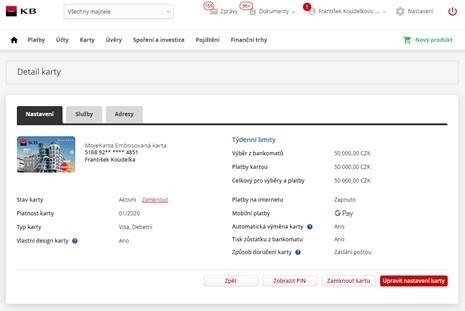

Overview of your cards and associated services

Information about your payment cards is now more transparent. Together with a new overview, this section also shows all agreed or available services. Therefore, you can keep track of all benefits your cards offer.

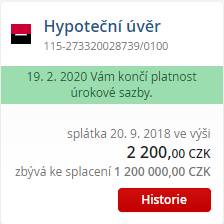

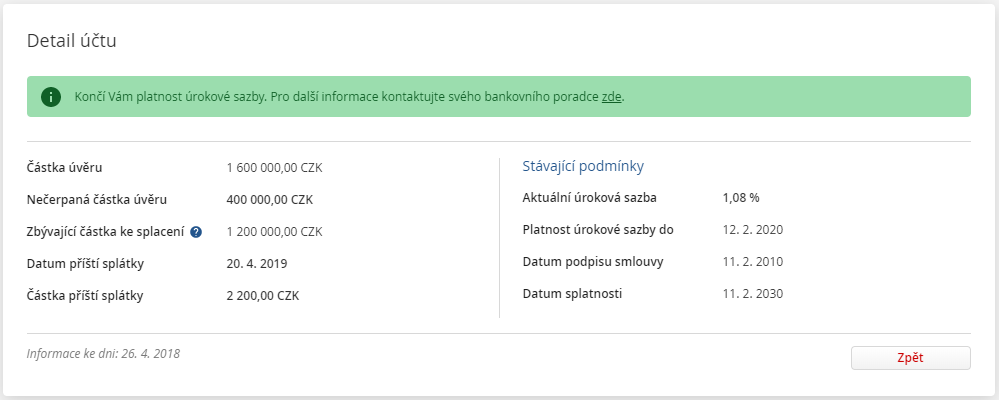

New interest rate for your mortgage loan

In MojeBanka Internet banking, we will notify you in good time of the approaching deadline for the refixation of your mortgage loan. By clicking on the notification, you can simply make an appointment with your bank advisor and negotiate new mortgage loan terms. We will then display the newly agreed conditions in the details of your mortgage loan. You will see it on the Android operating system in Mobilní banka from the start of December.

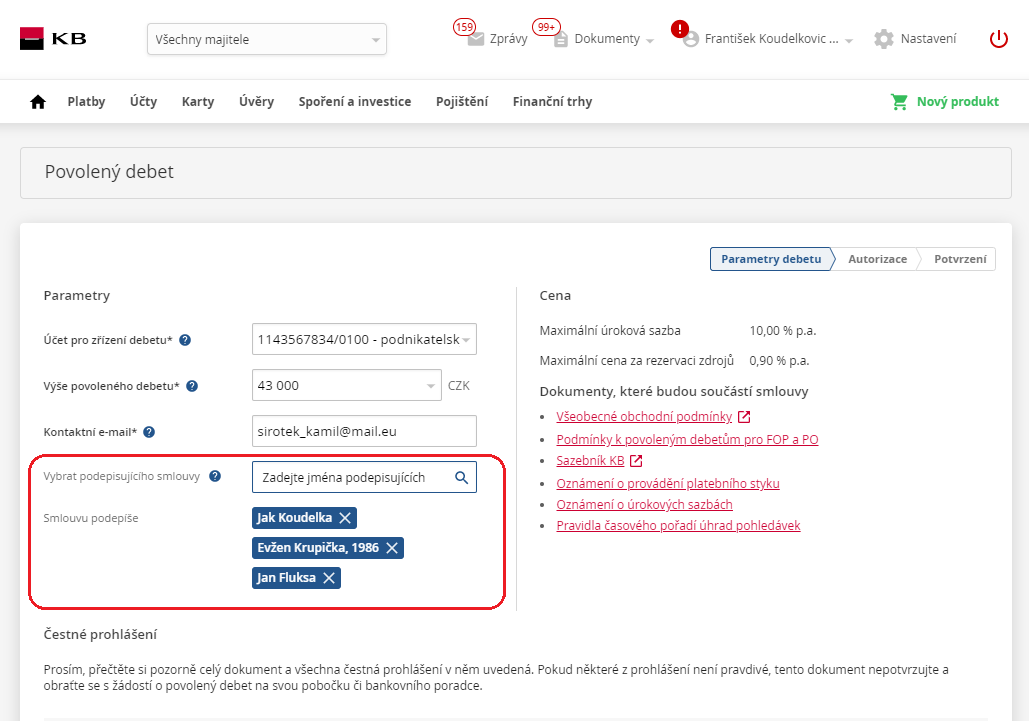

Authorised overdraft online – even for legal entities with several statutory body members

Are you a legal entity with several statutory body members? You can newly apply for an authorised overdraft online. The MojeBanka Internet banking now allows you to identify several statutory body members who can sign an authorised overdraft agreement on behalf of your company. You can select one or several individuals. This option is available in the “Authorised overdraft application” guide, in the “Select agreement signatory” field. Specify the statutory body member or members to sign the authorised overdraft agreement on the company’s behalf.

Confirmation of interest paid on home loans in electronic form

Starting from January, you can download a confirmation of interest paid on home loans in your MojeBanka and MojeBanka Business Internet banking. This confirmation is available for mortgage and pre-mortgage loans and can be used for tax-related purposes. To download your confirmation, go to the “Documents” tab and select “Statements and confirmations”.

Uniform format of direct debits for O2 services

Until now, it was necessary to set up a separate direct debit mandate for each service provided by O2. Moreover, the forms for O2 were different from standard direct debits. However, the forms have now been unified. You can thus use one form for O2 services and standard direct debits. Direct debits mandates will have a uniform format in an overview as well. We will automatically convert any existing O2 direct debit mandates to the new format. Direct debits will thus be more transparent and easier to update.

Repeated processing of payments under standing orders

We try to ensure that payments under standing orders are successfully executed – even if there are some problems during the processing stage (such as insufficient account balance). Therefore, if we are unable to process your payment on a specified due date, we will try again on the following business days. In case of standing orders with frequency of more than 14 days, we will try to process the relevant payment(s) for the following 4 business days. If you receive any funds in your account before then, we will execute the relevant payment.

Email notifications for standing orders

Set up email notifications and keep track of all executed payments. We will notify you if we are unable to process any payments under standing orders and inform you about the date up to which we will try again. In the notification, you can immediately see how to resolve the given situation, together with the relevant deadline.

Direct debits now sent to other banks more quickly

Direct debit orders for collecting funds from clients in other domestic banks will now be transferred to third-party banks on the same day. You only need to do the following:

- Submit a direct debit order by 2:00 pm on a business day;

- Use an online form in the MojeBanka application; or

- Import a batch with a request for online processing; or

- Submit in a standard manner.

Depending on the processing procedure of third-party bank, transfers of funds may be faster.

Do you use SEPA payments?

In connection with the revised rules for the processing of SEPA payments and SEPA direct debits, the “Payment purpose – Description” field will no longer be supported. The field is optional; however, if you complete it, the information will be deleted and will not be transferred to either you or the beneficiary as of 17 November 2019. Instead of the aforementioned field, you can use the “Message for beneficiary” field – there will be no difference. This change applies to the Internet banking MojeBanka, MojeBanka Business, Profibanka, and Multicash.

News in Instant Payments

Instant payments growing

In addition to MojeBanka, Mobilní banka, and Mobilní banka Business Internet banking, it is now possible to submit instant/immediate payments from the MojeBanka Business Internet banking. This concerns nonrecurring individual payments to CZK accounts. Instant payments are free of charge, whereas beneficiary’s account is credited within 10 seconds! Instant payments (both incoming and outgoing) are currently available for the following banks: AirBank, Banka CREDITAS, Česká spořitelna, PPF banka, and Raiffeisenbank.

News in Multibanking

Multibanking or account linking

You have been able to link accounts from other banks in one place for a while; to the MojeBanka Internet Banking and Mobilní banka Internet Banking.

We are continuously adding banks which can be linked to your KB account. At the moment, accounts of Česká spořitelna, AirBank, Equa Bank, Fio Bank, Moneta, J&T, Wüstenrot, CREDITAS, Raiffeisenbank, ČSOB, Poštovní spořitelna and Slovak TATRA Bank can be linked.

Why is it good to have accounts linked?

- You have an overview of all your accounts from different banks in one place in KB

- Everything is safe, because even your linked accounts are protected by KB systems

- Possibility to check balance and transaction history on both computer and mobile

- The service is free

- As of 16th Nov 2019, the number of accounts you can have linked is changing

All of your current, savings, credit, and business accounts can be linked. Instructions on how to link accounts can be found on our website - Link accounts

News in Internet Banking MojeBanka Business

Uniform format of direct debits for O2 services

Until now, it was necessary to set up a separate direct debit mandate for each service provided by O2. Moreover, the forms for O2 were different from standard direct debits. However, the forms have now been unified. You can thus use one form for O2 services and standard direct debits. Direct debits mandates will have a uniform format in an overview as well. We will automatically convert any existing O2 direct debit mandates to the new format. Direct debits will thus be more transparent and easier to update.

Confirmation of interest paid on home loans in electronic form

Starting from January, you can download a confirmation of interest paid on home loans in your MojeBanka and MojeBanka Business Internet banking. This confirmation is available for mortgage and pre-mortgage loans and can be used for tax-related purposes. To download your confirmation, go to the “Documents” tab and select “Statements and confirmations”.

Repeated processing of payments under standing orders

We try to ensure that payments under standing orders are successfully executed – even if there are some problems during the processing stage (such as insufficient account balance). Therefore, if we are unable to process your payment on a specified due date, we will try again on the following business days. In case of standing orders with frequency of more than 14 days, we will try to process the relevant payment(s) for the following 4 business days. If you receive any funds in your account before then, we will execute the relevant payment.

Email notifications for standing orders

Set up email notifications and keep track of all executed payments. We will notify you if we are unable to process any payments under standing orders and inform you about the date up to which we will try again. In the notification, you can immediately see how to resolve the given situation, together with the relevant deadline.

Direct debits now sent to other banks more quickly

Direct debit orders for collecting funds from clients in other domestic banks will now be transferred to third-party banks on the same day. You only need to do the following:

- Submit a direct debit order by 2:00 pm on a business day;

- Use an online form in the MojeBanka application; or

- Import a batch with a request for online processing; or

- Submit in a standard manner.

Depending on the processing procedure of third-party bank, transfers of funds may be faster.

Do you use SEPA payments?

In connection with the revised rules for the processing of SEPA payments and SEPA direct debits, the “Payment purpose – Description” field will no longer be supported. The field is optional; however, if you complete it, the information will be deleted and will not be transferred to either you or the beneficiary as of 17 November 2019. Instead of the aforementioned field, you can use the “Message for beneficiary” field – there will be no difference. This change applies to the Internet banking MojeBanka, MojeBanka Business, Profibanka, and Multicash.

News in Mobilní Banka

Mobilní banka for people with visual impairment

We have enabled the Google TalkBack app for visually impaired users. It uses audible feedback for onscreen information; therefore, visually impaired users are now able to use Mobilní banka as well. Third-party apps logically require access to Mobilní banka. In general, we do not grant such access to prevent third-party apps from reading sensitive data, covertly in the background. However, we have tested Google TalkBack in the area of security to serve the needs of users with disabilities. We now know that it is 100% secure. Therefore, visually impaired users can now use Mobilní banka with Google TalkBack from A to Z.

Open an account online

Open an account using your mobile phone! Download the Mobilní banka app for Android. On the homepage, select the “I want to open an account online” option and then proceed according to onscreen instructions.

Manage your payment cards saved in another device

In the Mobilní Banka / Mobilní Banka Business app (for both Android and iOS), you can now see the list of all your cards used for Google Pay or Apple Pay. If you have more cards saved in another device, you can manage these cards in Mobilní banka – i.e. to lock, unlock or block them.

Confirmation of interest paid on home loans in electronic form

Starting from January, you can download a confirmation of interest paid on home loans in your MojeBanka and MojeBanka Business Internet banking. This confirmation is available for mortgage and pre-mortgage loans and can be used for tax-related purposes. To download your confirmation, go to the “Documents” tab and select “Statements and confirmations”.

Uniform format of direct debits for O2 services

Until now, it was necessary to set up a separate direct debit mandate for each service provided by O2. Moreover, the forms for O2 were different from standard direct debits. However, the forms have now been unified. You can thus use one form for O2 services and standard direct debits. Direct debits mandates will have a uniform format in an overview as well. We will automatically convert any existing O2 direct debit mandates to the new format. Direct debits will thus be more transparent and easier to update.

Repeated processing of payments under standing orders

We try to ensure that payments under standing orders are successfully executed – even if there are some problems during the processing stage (such as insufficient account balance). Therefore, if we are unable to process your payment on a specified due date, we will try again on the following business days. In case of standing orders with frequency of more than 14 days, we will try to process the relevant payment(s) for the following 4 business days. If you receive any funds in your account before then, we will execute the relevant payment.

News in Instant Payments

Instant payments growing

In addition to MojeBanka, Mobilní banka, and Mobilní banka Business Internet banking, it is now possible to submit instant/immediate payments from the MojeBanka Business Internet banking. This concerns nonrecurring individual payments to CZK accounts. Instant payments are free of charge, whereas beneficiary’s account is credited within 10 seconds! Instant payments (both incoming and outgoing) are currently available for the following banks: AirBank, Banka CREDITAS, Česká spořitelna, PPF banka, and Raiffeisenbank.

News in Multibanking

Multibanking or account linking

You have been able to link accounts from other banks in one place for a while; to the MojeBanka Internet Banking and Mobilní banka Internet Banking.

We are continuously adding banks which can be linked to your KB account. At the moment, accounts of Česká spořitelna, AirBank, Equa Bank, Fio Bank, Moneta, J&T, Wüstenrot, CREDITAS, Raiffeisenbank, ČSOB, Poštovní spořitelna and Slovak TATRA Bank can be linked.

Why is it good to have accounts linked?

- You have an overview of all your accounts from different banks in one place in KB

- Everything is safe, because even your linked accounts are protected by KB systems

- Possibility to check balance and transaction history on both computer and mobile

- The service is free

- As of 16th Nov 2019, the number of accounts you can have linked is changing

All of your current, savings, credit, and business accounts can be linked. Instructions on how to link accounts can be found on our website - Link accounts