- About Bank

- News

- Spring news in the digital world

Spring news in the digital world

News in MojeBanka internet banking

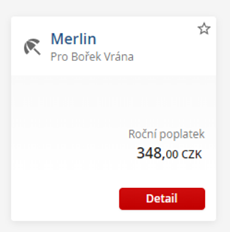

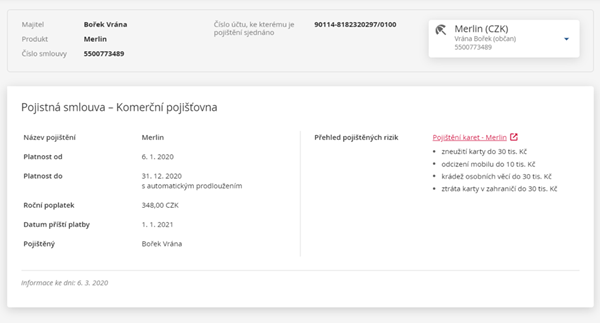

Merlin Insurance card in your internet banking product overview

If you have a Merlin, ProfiMerlin or Merlin Junior Insurance, it will be displayed as a separate product card in your MojeBanka internet banking. This will provide you with even more information about KB products and services you use. Your internet banking overview will also show your payment protection insurance (e.g. MojePojištění plateb or ProfiPojištění plateb).

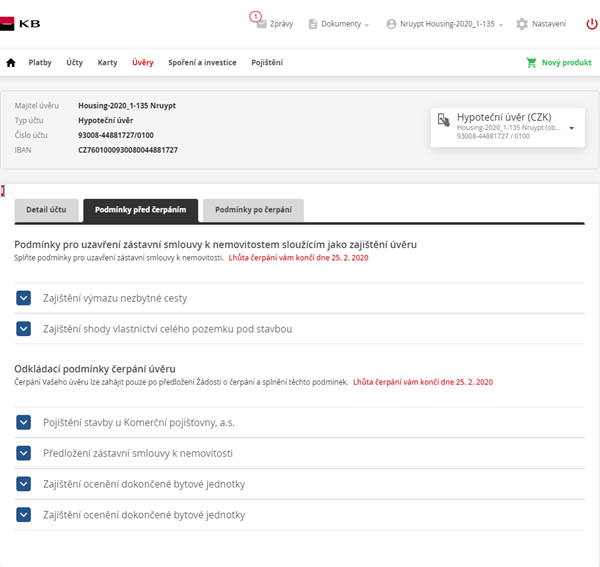

Mortgage loan terms and conditions – before and after the loan drawdown

If you have a mortgage loan in KB, you will see all the terms and conditions to be met – both before and after the loan drawdown – in the product details. Terms and conditions will be showed only for the deals arranged from April 21, 2020.

Preapproved credit product limits will not be shown before the GDPR consent is given

If you have not given your consent for marketing purposes to KB (or GDPR consent, as appropriate), we cannot show any preapproved credit product limits to you. This applies to individuals (natural persons) and entrepreneurs. In order to see such preapproved limits, simply contact us so that we can sign the marketing consent with you or you can give your consent to us using MojeBanka internet banking.

How can you do that?

Sign into MojeBanka and go to Settings and then to Processing of Personal Data.

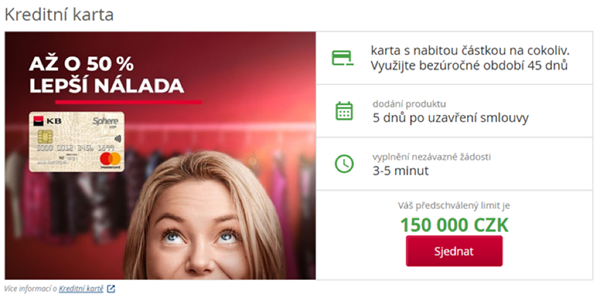

Debit card or credit card? Which is better?

The differences between debit and credit cards may sometimes be confusing. We have prepared a few clues for you. So, if you decide to get a payment card online, we will show you the key differences. You can thus be certain that you are getting the right card.

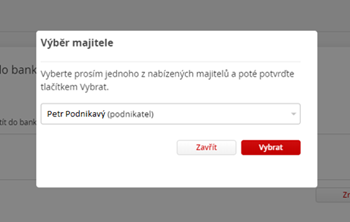

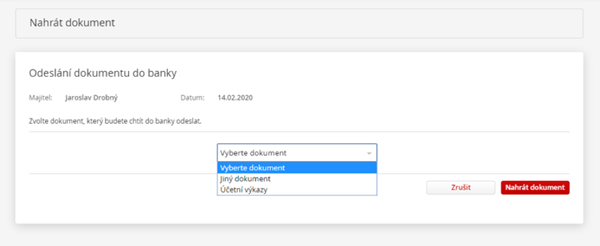

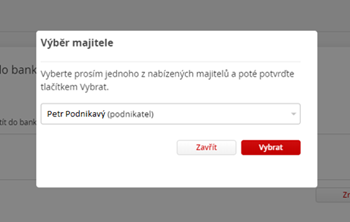

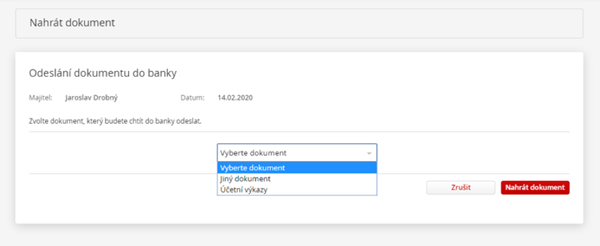

Documents uploaded by authorised users – even in case of entrepreneurs

Until now, documents could only be uploaded by users authorised by legal entities. However, this feature is newly available for users authorised by entrepreneurs as well. We believe you will find this option useful – particularly during these special times.

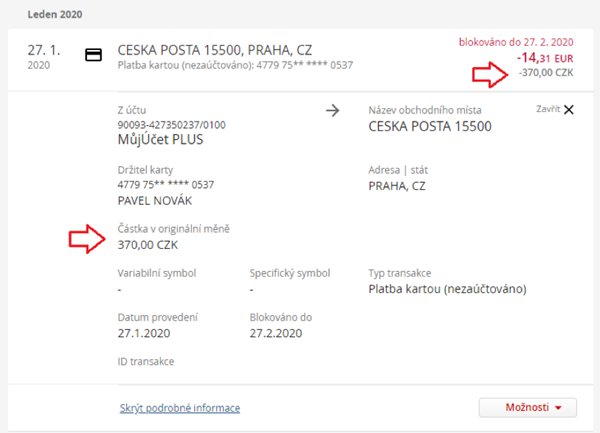

For card payments made abroad, the transaction amount will also be shown in the original currency in the transaction summary (e.g. in EUR, USD, etc.)

Your transaction summary will newly show two amounts – one is the local amount, i.e. in the country, where the payment took place, with the other one being the amount converted to Czech crowns. This will, for instance, allow you to review your vacation expenses both in euros and Czech crowns.

Have your ear to the ground

In your ou can configure notifications for domestic payments in line with your preferences. You do not want to be disturbed by any messages from the bank? Or maybe you wish to know about all transactions?

No problem, simply configure everything in the MojeBanka internet banking. Moreover, we have been continuously refining and improving email notifications. Almost all of them are now bilingual – in Czech and English.

In addition to notifications concerning the execution of domestic payments, you can newly set up notifications for pending payments – as part of notifications of unexecuted payments. Pending payments are payments that you have submitted; however, that have not been executed due to insufficient account balance.

News in MojeBanka Business internet banking

Documents uploaded by authorised users – even in case of entrepreneurs

Until now, documents could only be uploaded by users authorised by legal entities. However, this feature is newly available for users authorised by entrepreneurs as well. We believe you will find this option useful – particularly during these special times.

News in Mobilní banka app

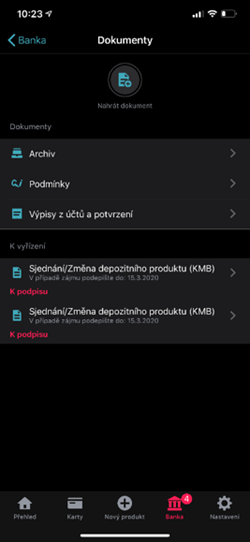

Sign documents directly in your app

All documents that could previously only be signed in the MojeBanka internet banking can now be signed in the Mobilní banka and Mobilní banka Business as well. This applies to both Android and iOS. Just a few taps and documents prepared by the bank are signed.

Hide products and define your primary account

You can now customize the way your products and services are displayed in line with your needs. For example, you can select one of your accounts as the primary account – this account will always be displayed first. You can also hide all other accounts. This new feature is available for Android and iOS.

.png)

Open your account online

Open an account online using your mobile phone or tablet! You first need to download the Mobilní banka app in App Store and install it. Once the app is installed, open in and select the “I want to open an account online” option on the main screen. Then follow in-app instructions. For Android, this feature is coming this autumn.