- Export and Import

- Bank guarantee

Bank guarantee

Reduce business risks in international trade

Risk mitigation

Risk mitigation and better terms

and conditions within the business relationship

and conditions within the business relationship

Letter of guarantee

A Letter of Guarantee prepared

as part of our assistance

as part of our assistance

Tailored to the business deal

Our bank guarantees are always

tailored to the business deal in question

tailored to the business deal in question

Payment guarantees

This guarantee is provided by the bank against a guarantee of the debtor’s bank, e.g. for the settlement of an invoice, loan, lease, rent, toll, excise tax, repayment of retention, advance payment, etc.

Customs guarantees

We issue customs guarantees for all standard customs procedures; these guarantees are accepted by customs authorities. For example, we provide guarantees for transit operations in international trade and operations other than transit operations.

Non-payment guarantees

They represent the bank’s obligation to pay up to the guaranteed amount in the event the principal fails to meet their obligation. We provide bind bonds, advance payment guarantees, performance bonds, retention bonds, warranty bonds, as well as other types of bonds.

Counter guarantees

By way of a counter guarantee, the issuing bank authorises another bank to issue a guarantee for the transaction in question. This guarantee is particularly suitable for transactions in specific territories (e.g. Arab countries), where the bank guarantee for the final creditor is issued by its local bank on the basis of a counter guarantee from the debtor’s bank.

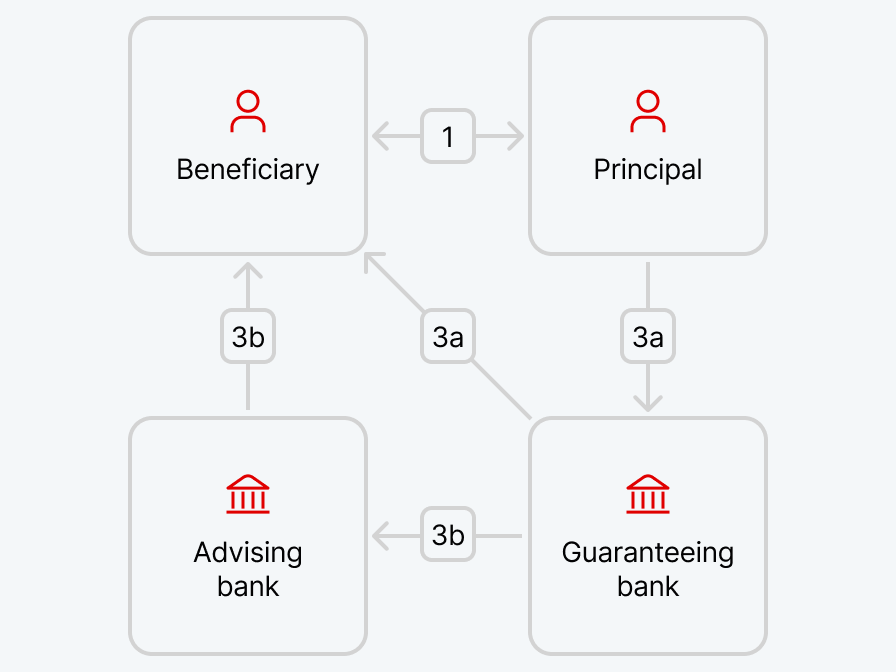

Bank guarantees are always defined for specific transactions

- A beneficiary submits an agreement (contract), terms and conditions of tender (public procurement), etc.

- A principal submits a request for a bank guarantee

- A guaranteeing bank sends the letter of guarantee directly to the beneficiary and the advising bank

- The letter of guarantee is sent via the advising bank

Why use a bank guarantee

- Get better contract terms by providing quality security to your business partner (e.g. the possibility to obtain a deferment of payment obligations, advance payment or retention against the provided bank guarantee)

- Assurance to the recipient of the bank guarantee that they will receive funds even if the business partner fails to meet their obligations

- This also includes consulting on negotiating contracts, review of the terms and conditions, drafting of the letter of guarantee, advice of an incoming bank guarantee, and promise to issue a bank guarantee

Pavel Dubanský

+420 955 532 846, +420 602 428 791

pavel_dubansky@kb.cz

Represents:

Benešov, Česká Lípa, Děčín, Hradec Králové, Chrudim, Jablonec nad Nisou, Jičín, Kolín, Kutná Hora, Liberec, Litoměřice, Louny, Mělník, Mladá Boleslav, Most, Náchod, Nymburk, Pardubice, Praha – východ, Rychnov nad Kněžnou, Semily, Teplice, Trutnov, Ústí nad Labem

pavel_dubansky@kb.cz

Represents:

Benešov, Česká Lípa, Děčín, Hradec Králové, Chrudim, Jablonec nad Nisou, Jičín, Kolín, Kutná Hora, Liberec, Litoměřice, Louny, Mělník, Mladá Boleslav, Most, Náchod, Nymburk, Pardubice, Praha – východ, Rychnov nad Kněžnou, Semily, Teplice, Trutnov, Ústí nad Labem

Michal Obručník

+420 955 532 093, +420 737 226 658

michal_obrucnik@kb.cz

Represents:

Beroun, České Budějovice, Český Krumlov, Domažlice, Cheb, Chomutov, Jindřichův Hradec, Karlovy Vary, Kladno, Klatovy, Písek, Plzeň, Plzeň – jih, Plzeň – sever, Praha, Praha Západ, Prachatice, Příbram, Rakovník, Rokycany, Sokolov, Strakonice, Tábor, Tachov

michal_obrucnik@kb.cz

Represents:

Beroun, České Budějovice, Český Krumlov, Domažlice, Cheb, Chomutov, Jindřichův Hradec, Karlovy Vary, Kladno, Klatovy, Písek, Plzeň, Plzeň – jih, Plzeň – sever, Praha, Praha Západ, Prachatice, Příbram, Rakovník, Rokycany, Sokolov, Strakonice, Tábor, Tachov

Radek Mendlík

+420 955 583 920, +420 724 112 503

radek_mendlik@kb.cz

Represents:

Blansko, Brno, Brno – venkov, Bruntál, Břeclav, Frýdek-Místek, Havlíčkův Brod, Hodonín, Jeseník, Jihlava, Karviná, Kroměříž, Nový Jičín, Olomouc, Opava, Ostrava, Pelhřimov, Prostějov, Přerov, Svitavy, Šumperk, Třebíč, Uherské Hradiště, Ústí nad Orlicí, Vsetín, Vyškov, Zlín, Znojmo, Žďár nad Sázavou

radek_mendlik@kb.cz

Represents:

Blansko, Brno, Brno – venkov, Bruntál, Břeclav, Frýdek-Místek, Havlíčkův Brod, Hodonín, Jeseník, Jihlava, Karviná, Kroměříž, Nový Jičín, Olomouc, Opava, Ostrava, Pelhřimov, Prostějov, Přerov, Svitavy, Šumperk, Třebíč, Uherské Hradiště, Ústí nad Orlicí, Vsetín, Vyškov, Zlín, Znojmo, Žďár nad Sázavou

Libor Macášek

Podnikatelé a malé firmy s obratem do 60 milionů

+420 955 532 923, +420 602 404 331

libor_macasek@kb.cz

Represents:

Česká republika

+420 955 532 923, +420 602 404 331

libor_macasek@kb.cz

Represents:

Česká republika