Export and Import

International trade financing and guarantees

A reliable partner for exporters and importers

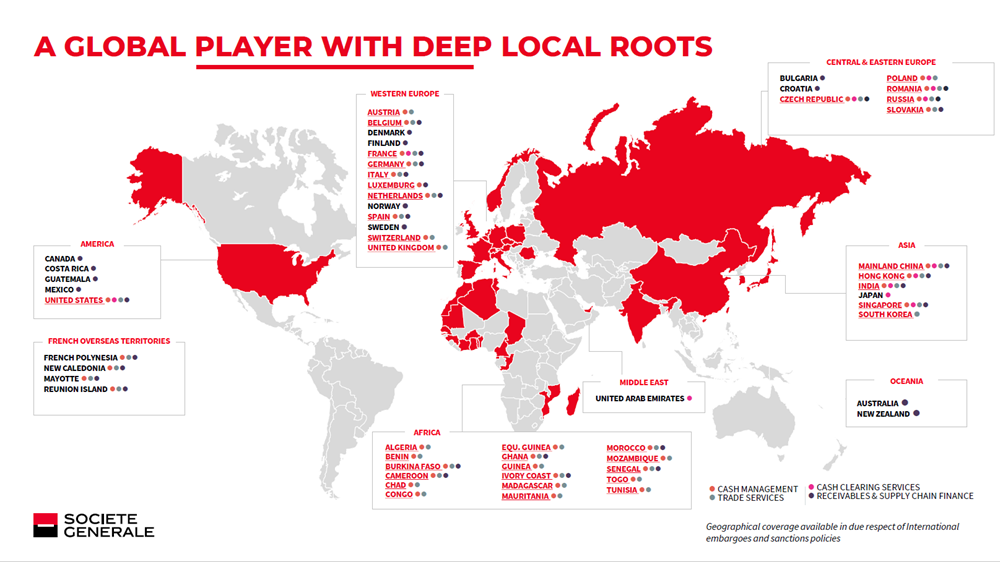

- Société Générale employees in each of the more than 70 countries around the world have direct knowledge of the environment and its specificities

- In the Czech Republic, an extensive team of experts will assist you with issues relating to export and import financing and guarantees

Pavel Dubanský

+420 955 532 846, +420 602 428 791

pavel_dubansky@kb.cz

Represents:

Benešov, Česká Lípa, Hradec Králové, Chrudim, Jablonec nad Nisou, Jičín, Kolín, Kutná Hora, Liberec, Mladá Boleslav, Náchod, Nymburk, Pardubice, Praha – východ, Rychnov nad Kněžnou, Semily, Svitavy, Ústí nad Orlicí, Trutnov

pavel_dubansky@kb.cz

Represents:

Benešov, Česká Lípa, Hradec Králové, Chrudim, Jablonec nad Nisou, Jičín, Kolín, Kutná Hora, Liberec, Mladá Boleslav, Náchod, Nymburk, Pardubice, Praha – východ, Rychnov nad Kněžnou, Semily, Svitavy, Ústí nad Orlicí, Trutnov

Michal Obručník

+420 955 532 093, +420 737 226 658

michal_obrucnik@kb.cz

Represents:

Beroun, České Budějovice, Český Krumlov, Děčín, Domažlice, Cheb, Chomutov, Jindřichův Hradec, Karlovy Vary, Kladno, Klatovy, Litoměřice, Louny, Mělník, Most, Písek, Plzeň, Plzeň – jih, Plzeň – sever, Praha, Praha Západ, Prachatice, Příbram, Rakovník, Rokycany, Sokolov, Strakonice, Ústí nad Labem, Tábor, Tachov, Teplice

michal_obrucnik@kb.cz

Represents:

Beroun, České Budějovice, Český Krumlov, Děčín, Domažlice, Cheb, Chomutov, Jindřichův Hradec, Karlovy Vary, Kladno, Klatovy, Litoměřice, Louny, Mělník, Most, Písek, Plzeň, Plzeň – jih, Plzeň – sever, Praha, Praha Západ, Prachatice, Příbram, Rakovník, Rokycany, Sokolov, Strakonice, Ústí nad Labem, Tábor, Tachov, Teplice

Radek Mendlík

+420 955 583 920, +420 724 112 503

radek_mendlik@kb.cz

Represents:

Blansko, Brno, Brno – venkov, Bruntál, Břeclav, Frýdek-Místek, Havlíčkův Brod, Hodonín, Jeseník, Jihlava, Karviná, Kroměříž, Nový Jičín, Olomouc, Opava, Ostrava, Pelhřimov, Prostějov, Přerov, Šumperk, Třebíč, Uherské Hradiště, Vsetín, Vyškov, Zlín, Znojmo, Žďár nad Sázavou

radek_mendlik@kb.cz

Represents:

Blansko, Brno, Brno – venkov, Bruntál, Břeclav, Frýdek-Místek, Havlíčkův Brod, Hodonín, Jeseník, Jihlava, Karviná, Kroměříž, Nový Jičín, Olomouc, Opava, Ostrava, Pelhřimov, Prostějov, Přerov, Šumperk, Třebíč, Uherské Hradiště, Vsetín, Vyškov, Zlín, Znojmo, Žďár nad Sázavou

Libor Macášek

Enterpreneurs and small businesses with turnover up to do 60 millions

+420 955 532 923, +420 602 404 331

libor_macasek@kb.cz

Represents:

Česká republika

+420 955 532 923, +420 602 404 331

libor_macasek@kb.cz

Represents:

Česká republika

Tailored products and services

- We are a large and strong bank that has a solution for every situation

- We serve 46% of corporate clients in the Czech Republic

- We are happy to come to you - 130 professionally trained and experienced relationship managers are available in all regions of the Czech Republic

Online banking

- Internet and mobile banking for businesses – MojeBanka Business, Mobilní banka Business

- Mobilní banka was named the best banking app (Finparáda 2019 and TOP APP 2020)

- Profibanka – a robust application for a large number of payments

- API – application programming interface allows you to share information with the bank directly

Security and support

- We monitor transaction security, detect frauds online and verify directly with you if necessary

- KB Klíč – it enables secure authorisation of payments, documents and identity verification in the digital world

- Contact centre of trained bankers available 24/7