Financing of export supplier credit

Possibility to receive payment immediately after delivery

Eliminate the risk of non-payment

by the buyer

by the buyer

You can offer deferred payment

to foreign customers

to foreign customers

Prepare the purchase of receivables

during the pre-contract phase already

during the pre-contract phase already

How to obtain financing of export receivables

- Financing of an export receivables should be discussed with the bank when negotiating the terms of transactions between an exporter and a foreign buyer.

- Terms of financing of export receivables are always addressed and specified in the relevant assignment agreement between the exporter and the bank, under which the bank becomes the owner of the receivables / creditor.

Contractual documentation necessary to obtain financing

- Business contract between an exporter and a foreign buyer

- Assignment agreement between KB and the exporter

- Tripartite insurance policy between KB (as the insured), EGAP (as the insurer), and the exporter (as the policyholder)

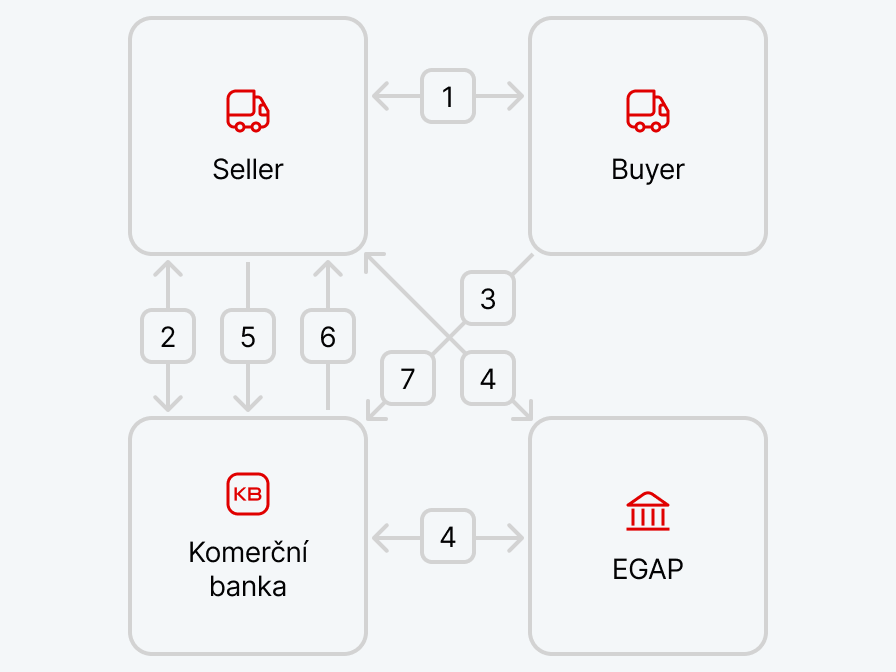

- The exporter and the importer negotiate a contract with the possibility of financing of export receivables, i.e. granting an export supplier credit.

- The exporter agrees the provision of financing of export receivables with the bank.

- The bank agrees with the importer the terms of export receivables, i.e. the importer’s recognition of the obligation.

- The bank or the exporter agrees the terms with the insurance company EGAP and concludes the insurance policy.

- In case the exporter is the insured, they send documents to the bank and execute the loss payee clause.

- The bank remits funds to the exporter – this remains unchanged.

- Receivables are settled by the importer.

Pavel Dubanský

+420 955 532 846, +420 602 428 791

pavel_dubansky@kb.cz

Represents:

Benešov, Česká Lípa, Hradec Králové, Chrudim, Jablonec nad Nisou, Jičín, Kolín, Kutná Hora, Liberec, Mladá Boleslav, Náchod, Nymburk, Pardubice, Praha – východ, Rychnov nad Kněžnou, Semily, Svitavy, Ústí nad Orlicí, Trutnov

pavel_dubansky@kb.cz

Represents:

Benešov, Česká Lípa, Hradec Králové, Chrudim, Jablonec nad Nisou, Jičín, Kolín, Kutná Hora, Liberec, Mladá Boleslav, Náchod, Nymburk, Pardubice, Praha – východ, Rychnov nad Kněžnou, Semily, Svitavy, Ústí nad Orlicí, Trutnov

Michal Obručník

+420 955 532 093, +420 737 226 658

michal_obrucnik@kb.cz

Represents:

Beroun, České Budějovice, Český Krumlov, Děčín, Domažlice, Cheb, Chomutov, Jindřichův Hradec, Karlovy Vary, Kladno, Klatovy, Litoměřice, Louny, Mělník, Most, Písek, Plzeň, Plzeň – jih, Plzeň – sever, Praha, Praha Západ, Prachatice, Příbram, Rakovník, Rokycany, Sokolov, Strakonice, Ústí nad Labem, Tábor, Tachov, Teplice

michal_obrucnik@kb.cz

Represents:

Beroun, České Budějovice, Český Krumlov, Děčín, Domažlice, Cheb, Chomutov, Jindřichův Hradec, Karlovy Vary, Kladno, Klatovy, Litoměřice, Louny, Mělník, Most, Písek, Plzeň, Plzeň – jih, Plzeň – sever, Praha, Praha Západ, Prachatice, Příbram, Rakovník, Rokycany, Sokolov, Strakonice, Ústí nad Labem, Tábor, Tachov, Teplice

Radek Mendlík

+420 955 583 920, +420 724 112 503

radek_mendlik@kb.cz

Represents:

Blansko, Brno, Brno – venkov, Bruntál, Břeclav, Frýdek-Místek, Havlíčkův Brod, Hodonín, Jeseník, Jihlava, Karviná, Kroměříž, Nový Jičín, Olomouc, Opava, Ostrava, Pelhřimov, Prostějov, Přerov, Šumperk, Třebíč, Uherské Hradiště, Vsetín, Vyškov, Zlín, Znojmo, Žďár nad Sázavou

radek_mendlik@kb.cz

Represents:

Blansko, Brno, Brno – venkov, Bruntál, Břeclav, Frýdek-Místek, Havlíčkův Brod, Hodonín, Jeseník, Jihlava, Karviná, Kroměříž, Nový Jičín, Olomouc, Opava, Ostrava, Pelhřimov, Prostějov, Přerov, Šumperk, Třebíč, Uherské Hradiště, Vsetín, Vyškov, Zlín, Znojmo, Žďár nad Sázavou

Libor Macášek

Enterpreneurs and small businesses with turnover up to do 60 millions

+420 955 532 923, +420 602 404 331

libor_macasek@kb.cz

Represents:

Česká republika

+420 955 532 923, +420 602 404 331

libor_macasek@kb.cz

Represents:

Česká republika