- Export and Import

- Documentary Letter of Credit

Documentary Letter of Credit

Irrevocable payment security for business transactions by a bank, both domestically and abroad

Payment security

The supplier is assured of receiving payment

after the letter of credit conditions are met

Protection against default

Protection against default

or failure to deliver goods

or failure to deliver goods

Better price or deferred payment

The buyer can negotiate a better price

or deferred payment thanks to payment security

or deferred payment thanks to payment security

Advantages of a letter of credit

For the buyer

- The buyer is assured that the goods have been shipped before payment.

- The buyer can obtain better pricing terms from the partner by providing quality payment security by means of the letter of credit.

- The seller agrees to carry out the delivery at the specified time and in accordance with the terms of the letter of credit.

For the seller

- The principal is assured that the payment of the pre-agreed amount is subject to the fulfilment of terms and conditions that are known in advance - the transaction can be carried out without fear that the buyer fails to take delivery of the ordered goods.

- Once the letter of credit conditions are met, the payment is made by the bank, not the buyer.

- The buyer then makes payment to their bank.

Import and export letter of credit

An import letter of credit is opened by a buyer with their bank to ensure payment to their seller.

On the other hand, an export letter of credit is intended to guarantee that a seller receives payment from their foreign buyer.

On the other hand, an export letter of credit is intended to guarantee that a seller receives payment from their foreign buyer.

Advised letter of credit

An advised letter of credit is only notified (advised) by the bank to the beneficiary without the bank assuming any financial risk. A confirmed letter of credit means that the beneficiary bank guarantees payment even if the bank opening the letter of credit fails to meet its obligations.

Transferable letter of credit

This letter of credit can be fully or partially transferred to a third party, allowing, for example, the involvement of multiple subcontractors.

Revolving letter of credit

It is automatically renewed for recurring business transactions, which is suitable for regular deliveries of goods.

Standby letter of credit

It serves as a back-up payment security in case the debtor fails to meet its obligations, often replacing a bank guarantee.

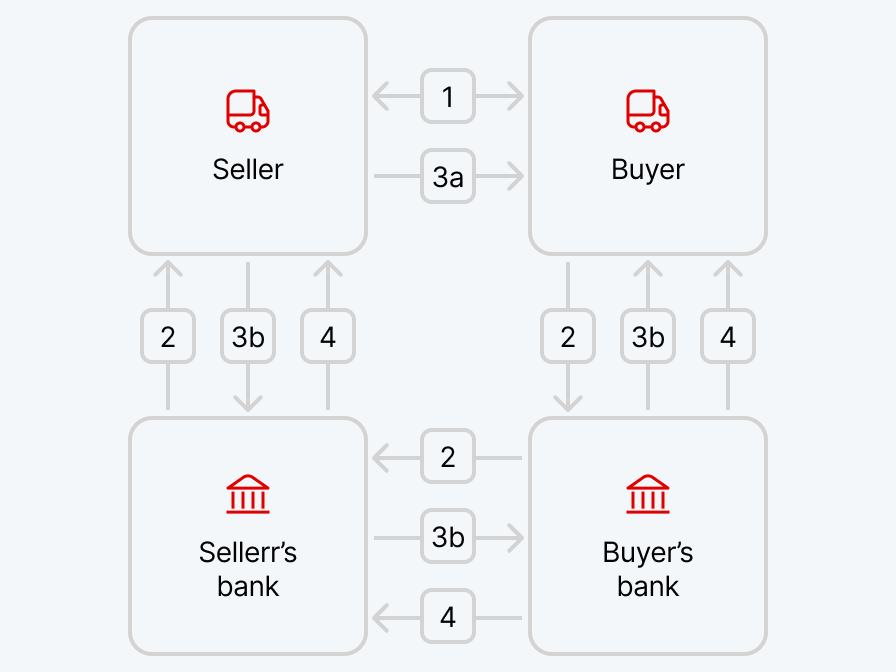

- The seller and the buyer enter into a purchase contract.

- Based on the Purchase Agreement and its terms, the Buyer requests its bank to open a letter of credit.

-

- The seller sends goods to the buyer.

- The seller submits documents to their bank, which sends them to the buyer’s bank and, if the conditions are met, forwards them to the buyer.

- The buyer’s bank shall pay the letter of credit to the seller.

Pavel Dubanský

+420 955 532 846, +420 602 428 791

pavel_dubansky@kb.cz

Represents:

Benešov, Česká Lípa, Děčín, Hradec Králové, Chrudim, Jablonec nad Nisou, Jičín, Kolín, Kutná Hora, Liberec, Litoměřice, Louny, Mělník, Mladá Boleslav, Most, Náchod, Nymburk, Pardubice, Praha – východ, Rychnov nad Kněžnou, Semily, Teplice, Trutnov, Ústí nad Labem

pavel_dubansky@kb.cz

Represents:

Benešov, Česká Lípa, Děčín, Hradec Králové, Chrudim, Jablonec nad Nisou, Jičín, Kolín, Kutná Hora, Liberec, Litoměřice, Louny, Mělník, Mladá Boleslav, Most, Náchod, Nymburk, Pardubice, Praha – východ, Rychnov nad Kněžnou, Semily, Teplice, Trutnov, Ústí nad Labem

Michal Obručník

+420 955 532 093, +420 737 226 658

michal_obrucnik@kb.cz

Represents:

Beroun, České Budějovice, Český Krumlov, Domažlice, Cheb, Chomutov, Jindřichův Hradec, Karlovy Vary, Kladno, Klatovy, Písek, Plzeň, Plzeň – jih, Plzeň – sever, Praha, Praha Západ, Prachatice, Příbram, Rakovník, Rokycany, Sokolov, Strakonice, Tábor, Tachov

michal_obrucnik@kb.cz

Represents:

Beroun, České Budějovice, Český Krumlov, Domažlice, Cheb, Chomutov, Jindřichův Hradec, Karlovy Vary, Kladno, Klatovy, Písek, Plzeň, Plzeň – jih, Plzeň – sever, Praha, Praha Západ, Prachatice, Příbram, Rakovník, Rokycany, Sokolov, Strakonice, Tábor, Tachov

Radek Mendlík

+420 955 583 920, +420 724 112 503

radek_mendlik@kb.cz

Represents:

Blansko, Brno, Brno – venkov, Bruntál, Břeclav, Frýdek-Místek, Havlíčkův Brod, Hodonín, Jeseník, Jihlava, Karviná, Kroměříž, Nový Jičín, Olomouc, Opava, Ostrava, Pelhřimov, Prostějov, Přerov, Svitavy, Šumperk, Třebíč, Uherské Hradiště, Ústí nad Orlicí, Vsetín, Vyškov, Zlín, Znojmo, Žďár nad Sázavou

radek_mendlik@kb.cz

Represents:

Blansko, Brno, Brno – venkov, Bruntál, Břeclav, Frýdek-Místek, Havlíčkův Brod, Hodonín, Jeseník, Jihlava, Karviná, Kroměříž, Nový Jičín, Olomouc, Opava, Ostrava, Pelhřimov, Prostějov, Přerov, Svitavy, Šumperk, Třebíč, Uherské Hradiště, Ústí nad Orlicí, Vsetín, Vyškov, Zlín, Znojmo, Žďár nad Sázavou

Libor Macášek

Podnikatelé a malé firmy s obratem do 60 milionů

+420 955 532 923, +420 602 404 331

libor_macasek@kb.cz

Represents:

Česká republika

+420 955 532 923, +420 602 404 331

libor_macasek@kb.cz

Represents:

Česká republika