- Securing Risks

- Currency Option Strategies

Currency Option Strategies

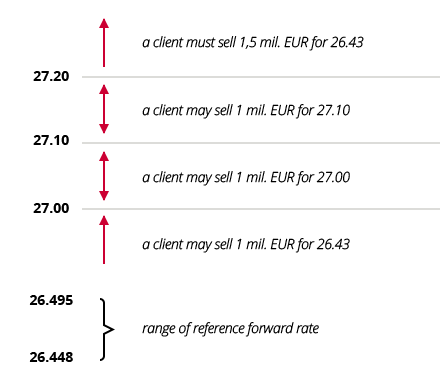

Execute a series of currency forwards at better than standard exchange rates

Zero initial cost

A team of experienced professionals

at your service

at your service

Execute transactions over the telephone – in any currency offered by KB

Benefit from better exchange rates with a correctly selected strategy

Monitor your transactions with confirmations