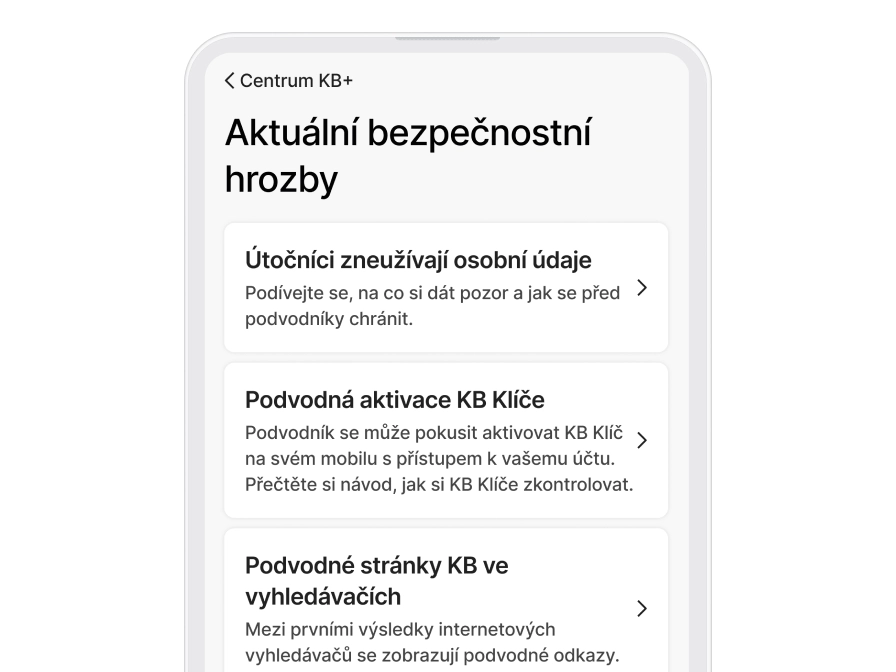

- FAQ and Support

- Security

- Payments on the Internet

Payments on the Internet

through online banking

with early intervention

every day and protect your money

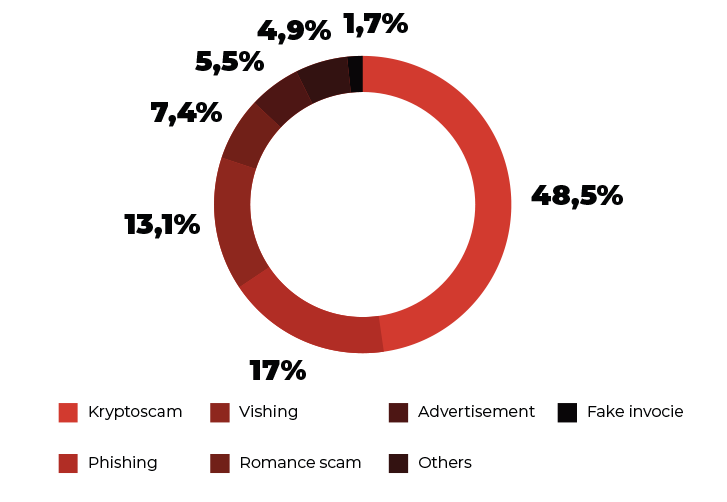

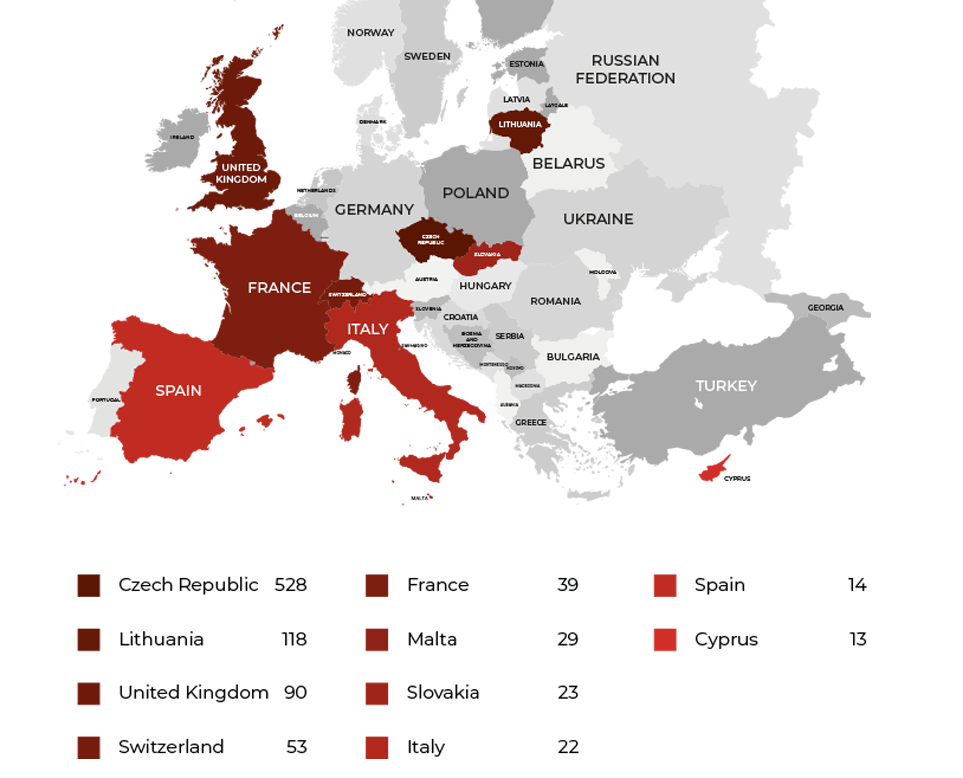

A large number of payments pass through banking systems every day, some of which may be fraudulent.

Banking systems operate around the clock and automatically evaluate every suspicious transaction, such as payments that show patterns of fraudulent behaviour - unusual amounts, suspicious payees or payments to unexpected and unusual locations. If the system detects anything out of the ordinary, it stops the transaction and then a security expert examines it in more detail. With these measures, we protect your money and minimise the risk of fraud.

Online payments are instantly checked automatically by the systems.

How payments are checked

Payments go through multiple levels of verification:

- Artificial Intelligence (AI) - detects suspicious behaviour patterns and warns of risky transactions.

- Advanced systems - automatically analyse thousands of data points and look for anomalies.

Security experts - a team of specialists monitor fraud trends and decide on the next course of action.

Prevention is essential

In addition to technological solutions, we also focus on education. Our specialists regularly train employees and clients on how to spot fraudulent practices and protect their finances. If you're not sure if you've been scammed, we'll be happy to advise you.

Payment security is our priority. Together, we can prevent fraud.

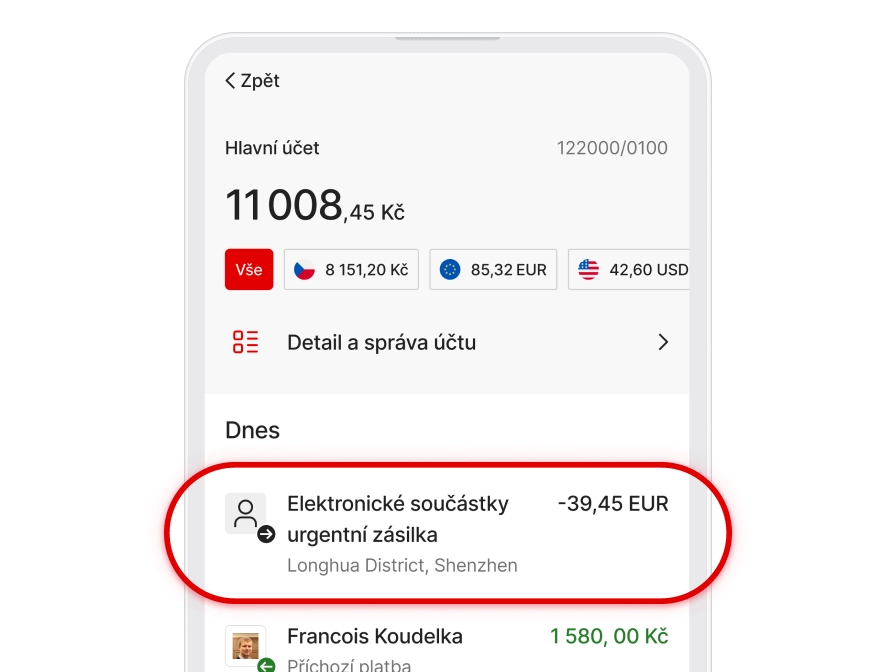

What to look out for when sending payments

A simple rule applies to all payments you make: Always check the payee and amount on the confirmation screen before confirming the payment.

Be especially careful with QR code payments. These are widely used today because they are fast, easy and convenient. This plays into the hands of fraudsters as it is not difficult to create a fake QR code that redirects your payment to another account.

unsolicited messages or emails

don't hesitate to contact the bank