Using KB payment cards

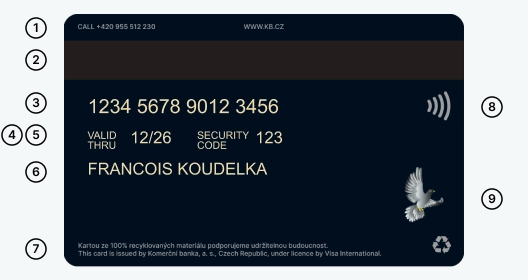

With some exceptions (such as deposit cards), all KB payment cards are embossed and contactless. Such cards may normally be used to make payments on the Internet or in stores, mobile payments, cash withdrawals or to book a hotel room, for example. In this section, you will learn more about contactless cards, using such cards, and types of transactions you can come across.

Did not find an answer?

KB Card Customer Service

Tel.:+420 955 512 230

E-mail: klientska_linka@kb.cz

We recommend that you save the contact info in your phone