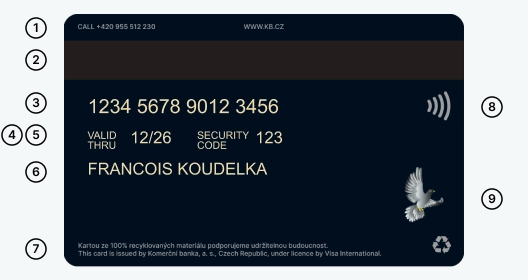

My new card from KB

Have you received or are you expecting a nex card?

- The card is yours and only yours. You should know where it is at all times and never lend it to anyone

- Keep your card either with you (ideally in your wallet) or in a safe place at home

- You can also upload your card in a mobile phone or watch. To safely confirm payments, use fingerprint reader or facial recognition

- Your card is not active until you either use it in an ATM or insert it in a POS terminal

- Make contactless payments by placing your hold near a POS terminal. You know that a transaction goes through when you hear a terminal beep. Only insert your card in a terminal, if specifically prompted by the terminal

- Before you make an ATM withdrawal, look around to make sure that no one will disturb you.

- You can also make contactless ATM withdrawals – if supported by the relevant ATM

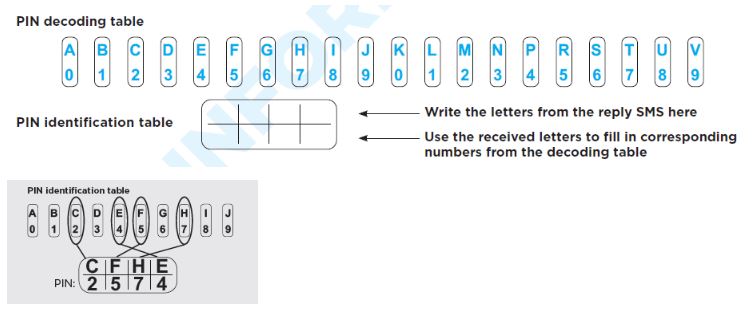

- Only you know the card PIN. Is it hard to forget or you just do not like it? Simply change it in a KB ATM

- Your card can also be conveniently used to make payments on the Internet. To confirm a payment, use a code sent via a text message (SMS) or KB Klíč

- Keep an eye on your card – do not disclose the card number to anyone and do not share pictures of your card on social media